August 2024 Iran Tanker Tracker

On August 7, Israel’s National Bureau for Counter-Terror Financing (NBCTF), part of the Ministry of Defense, sanctioned 18 tankers for their involvement in the illicit trade of Iranian oil, marking Israel’s first-ever shipping sanctions. Several of the vessels—with a total deadweight of almost 1.88 million tons—were engaged in “dark” (i.e., transponder-disabled) ship-to-ship (STS) transfers with another U.S.-sanctioned vessel off the Syrian coast. According to Israeli officials, these oil sales were likely overseen by the IRGC-Quds Force. They were helping to finance Iran-backed terrorist proxy and partner groups, including Hezbollah, Hamas, and the Houthis. Twelve of the freshly sanctioned vessels—which are now subject to Israeli “seizure orders”—have also previously transported banned Russian oil, while eight are members of UANI’s Ghost Armada, a fleet of over 400 tankers identified for their role in facilitating Iran’s illicit oil exports.

While China accounts for the lion’s share of Iranian oil exports, Syria is typically in second or third spot, taking in tens of thousands of barrels per day. On this (and other items), Western nations, including the U.S., are generally averse to ruffling Beijing’s feathers. By contrast, the Assad regime is widely recognized and explicitly called out as a malign actor and is broadly subject to tough autonomous sanctions by the U.S., the EU, and the UK.

Assad-focused Western sanctions explicitly include the conveyance of oil. For instance, in 2018 and 2019, the Office of Foreign Assets Control (OFAC) issued severe warnings against the transport and supply of petroleum to the Syrian government or other SDNs, which would “potentially open the carrier to the full force of penalties from the U.S. authorities, which will at best affect the future trading of the vessel and at worst could prove fatal to the future viability of a Member's whole enterprise.”

One of the key questions around this illicit trade is how Iran is compensated for its oil exports to Syria, given the extensive international sanctions in place. Payments are often made through a combination of barter agreements. Syria provides goods, services, or commodities to Iran in exchange for oil and other covert methods like cash transactions facilitated through smuggling networks or third-party intermediaries and shell companies. These methods allow Tehran and Damascus to circumvent the global financial system without the further headache of red flags that cross-border transactions would inevitably raise, given the banking sanctions imposed on both countries.

This “oil-for-goods” exchange is a lifeline for the Assad regime. It provides the necessary energy resources to keep the country running, supports the regime’s military operations, and allows for optimally reallocating limited financial reserves to other critical areas. Furthermore, it helps maintain and bolster the strategic Iran-Syria alliance, ensuring continued economic, military, and political support from Tehran, which is vital for Assad’s hold on power.

Given this closed and sanctions-evading loop of Iran-Syria trading—directed by the IRGC and funding multiple terrorist organizations—there is no obvious reason why the U.S., EU, and UK should not sanction the entirety of the same Israel-designated group. At present, only five of the 18 are sanctioned by Western authorities. Indeed, earlier this month, UANI called on “other nations to follow Israel’s lead and implement similar sanctions targeting specific vessels and networks facilitating the Iranian regime’s oil smuggling operations.” Israel has made the right call. Others should heed it.

Iranian oil exports for August 2024 are below:

| Country of Destination | August 2024 - Barrels Per Day (bpd)* | July 2024 - Barrels Per Day (bpd)* | June 2024 - Barrels Per Day (bpd)* |

| China | 1,532,529 | 1,533,126 | 1,473,426 |

| Syria | 81,837 | 93,052 | 36,503 |

| UAE | 12,500 | 88,362 | 118,115 |

| Unknown | 0 | 33,135 | 37,921 |

| Total | 1,626,866 | 1,762,414 | 1,699,431 |

*Figures to be updated over the following weeks

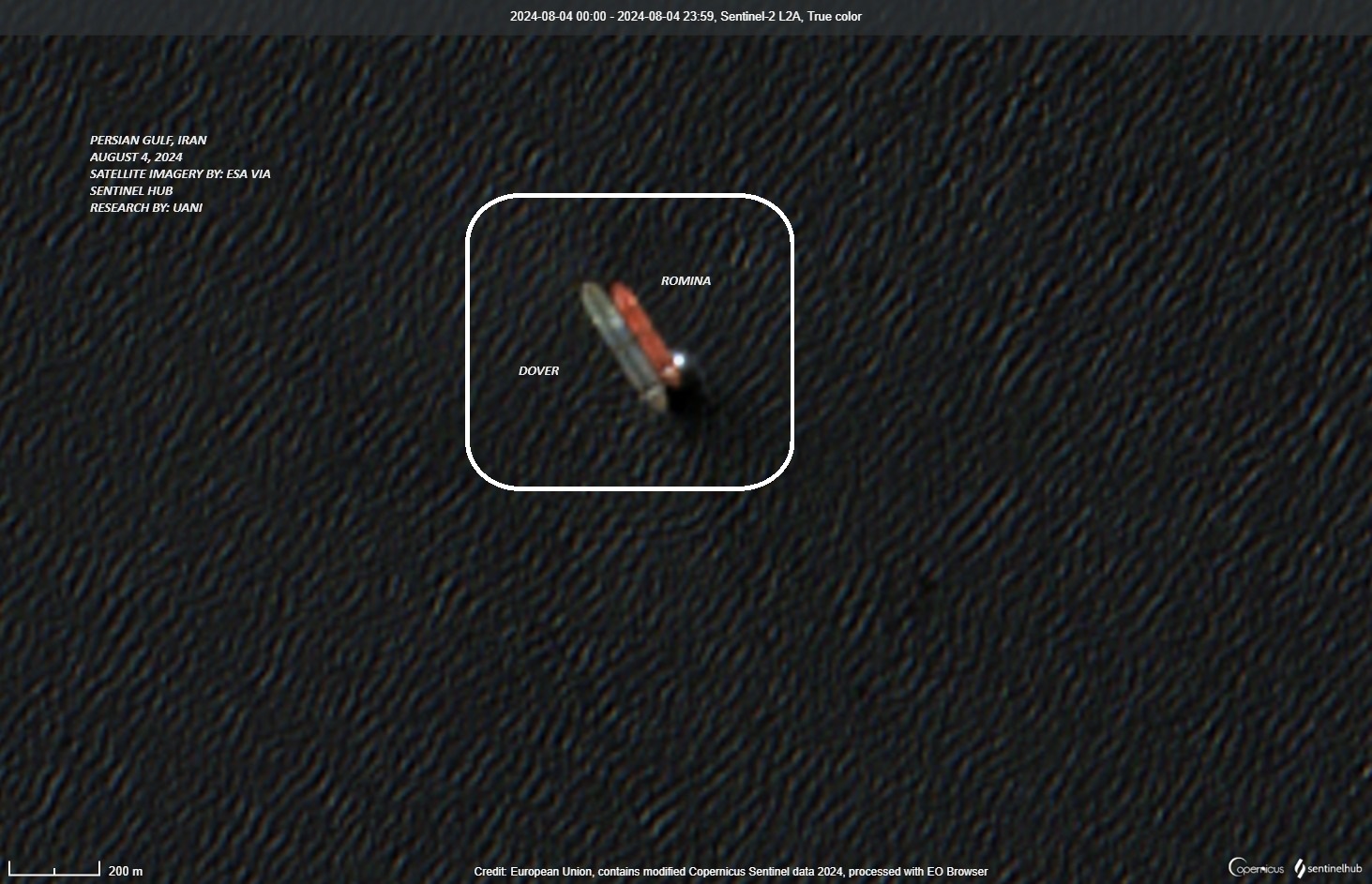

In August, additional vessels were identified as transporting Iranian oil to Syria, further underscoring the Assad regime’s dependence on these illicit shipments to sustain its economy and military. Notably, the Iranian-flagged Suezmax tanker ROMINA (IMO: 9114608), which is not sanctioned by the U.S. or Israel, is currently in transit with over 900k barrels of Iranian crude oil to Baniyas Syria. ROMINA received its cargo from the SDN-listed Iranian crude oil tanker DOVER (IMO: 9218466) on August 4, 2024, in the Persian Gulf.

Satellite imagery of ROMINA suspected of receiving Iranian oil from the crude oil tanker DOVER on August 4, 2024 (Source: Sentinel Hub)

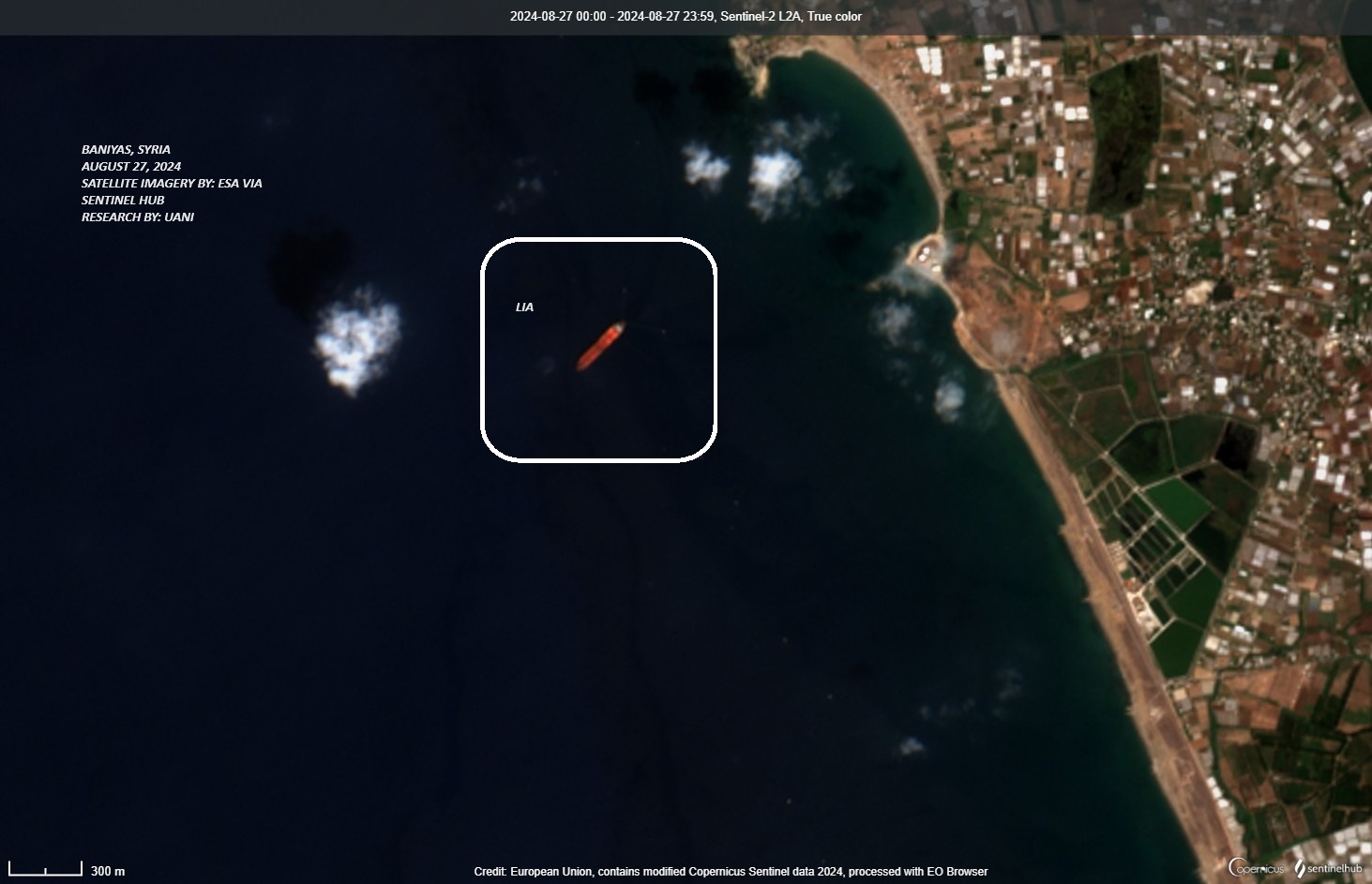

Additionally, the U.S.-sanctioned tanker LIA (IMO: 9041057), which is currently sailing with a false flag from Guyana, completed its delivery of Iranian crude oil to Baniyas, Syria, on August 27, 2024.

Satellite imagery of LIA offloading Iranian oil at Baniyas, Syria, on August 27, 2024 (Source: Sentinel Hub)

Given Israel’s unprecedented decision to identify certain Iranian oil-carrying vessels as subject to seizure, the action potentially marks a new phase in disrupting Iran’s illicit oil trade network. Certainly, the U.S., EU, and UK should also consider extending their own sanctions to cover these vessels. In doing so, they can help to close the enforcement gaps and disrupt the critical supply lines that Iran uses to support its regional proxies and the Assad regime. Such coordinated actions would not only enhance the effectiveness of existing sanctions but also send a strong message of international unity against state-sponsored terrorism and the regimes that support it.

Receive Iran News in Your Inbox.

Eye on Iran is a news summary from United Against Nuclear Iran (UANI), a section 501(c)(3) organization. Eye on Iran is available to subscribers on a daily basis or weekly basis.