Analysis of Iranian Oil Sales Under President Trump vs. President Biden

United Against Nuclear Iran’s (UANI’s) ship-tracking data and research shows that the Trump and Biden administrations had different impacts on Iran’s oil sector. The Trump administration sought to drive Iranian oil exports to zero and deprive the regime of a vital source of revenue. The Biden administration, by contrast, in focusing on negotiations to revive the nuclear deal, eased the pressure from sanctions via lax enforcement. As a result, Iran’s oil exports and revenue have drastically increased, enabling the regime to continue to engage in its malign activities. Additional evidence of this came on July 26, 2022, when Iran’s economy minister reported a 580% increase in income on sales from oil and gas condensate between March 2022 and July 2022, compared with that period last year. This blog elucidates the impact of former President Trump’s “maximum pressure” campaign, and the consequences of President Biden’s lax sanction enforcement.

After the U.S. withdrew from the nuclear deal in 2018, the Trump administration began the “maximum pressure” campaign, with the goal of increasing leverage over the Iranian regime. Sanctions on Iran’s oil sector were a critical part of that campaign. Throughout 2020, the Trump administration introduced several sanctions packages intended to curtail Iran’s illicit shipment of oil. For example, on October 26, 2020, the U.S. government designated the Iranian Ministry of Petroleum, the National Iranian Oil Company (NIOC), and the National Iranian Tanker Company (NITC) with terrorism sanctions.

By contrast, the Biden administration was eager to rejoin the nuclear deal, insisting that most of the sanctions from the Trump administration would be lifted if Iran returned to compliance with the accord. In the first six months of the Biden administration, no new sanctions were introduced on Iran’s oil sector. Finally, in August 2021, amid an extended break in the nuclear negotiations, the U.S. Treasury Department imposed new sanctions on an Omani businessman and companies linked to him, alleging that he was involved in an oil-smuggling network whose proceeds benefited the Islamic Revolutionary Guard Corps (IRGC)’s Quds Force. However, in the next nine months, the Biden administration largely failed to levy new sanctions to stanch the flow of oil revenue. Notably, Biden administration officials failed to pressure China, allowing it to drastically increase imports of Iranian oil during Biden’s first year in office. Rather than engaging in actual enforcement of sanctions, the U.S. government instead focused on diplomacy to persuade Beijing to halt its illicit oil imports. This approach to China clearly failed.

Using a data set spanning from April 2018 to July 2022, we determined the total volume and value of Iranian oil exports, taking into account the significant discount at which Iran sells its oil. Over this course of time, we observed how U.S. government policy could reduce Iranian oil export revenues. With the Biden presidency, we also observed how lax sanctions enforcement allowed Iran to increase its oil export revenue. By comparing data from President Trump’s last year in office in 2020, and President Biden’s first year in office, in 2021, we can see the impact of sanctions enforcement on Iranian government revenues. We can then see how increased oil export revenue translates to Iran’s military spending. When Iran’s oil export revenue increased, its military spending increased as well.

When looking at the revenue calculations in 2020 and 2021, it is clear that the Biden administration has allowed Iran to substantially increase revenue via oil exports to China. A core conclusion of our research is that there was a 116% increase in barrels of Iranian oil exported to China in 2021 (President Biden’s first year in office) compared with the last year of the Trump administration. In 2020, under President Trump, the Iranian regime sold a total of $6.6 billion of oil to China. In comparison, in 2021, the first year of Biden’s term in office, it sold $23.1 billion of oil to China. Part of this increase in the market value of the oil sold to China is due to an increase in oil price, but a large part is due to an increase in the total volume of Iranian oil exports.

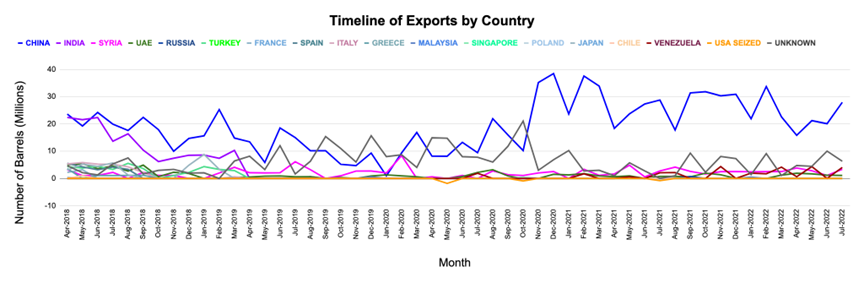

The following chart (“Timeline of Exports by Country”) depicts the volume of Iranian oil exports between April 2018 and July 2022. Some of the key statistics are:

- Between April 2018 and December 2018, Iran exported 568.5 million barrels of oil (2.07 million BPD). At that rate, Iran exported approximately 186.3 million barrels in the first three months of 2018, bringing its estimated total for 2018 to 754.8 million barrels.

- In 2019, Iran exported 354.2 million barrels (0.97 million BPD). The decrease from 2018 is a direct result of the sanctions exemption (SRE) program expiring in May 2019.

- In 2020, Iran exported only 315.8 million barrels (0.86 million BPD).

- In 2021, Iranian oil exports rose by 131 million barrels to 447.1 million (1.2 million BPD)—59% of the estimated 2018 volume.

- In Biden’s first year in office, China imported more barrels from Iran than its pre-sanction levels, at a rate of 939,000 barrels per day, compared to 639,000 barrels per day in 2018.

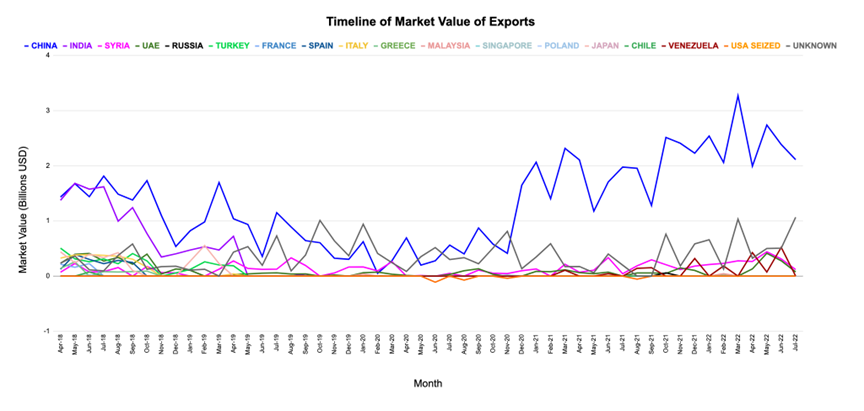

The next chart (“Timeline of Market Value of Exports”) depicts the market value of those exports. Some of the key statistics are:

- In 2018, we estimate that the market value of Iran’s oil exports was $53 billion

- In 2019, that number fell to $22.1 billion

- In 2020, to $12.7 billion. As a direct result of the U.S. withdrawal from the JCPOA, Iran shipped $41.3 billion worth of oil less in 2020 than in 2018—a 76% decrease.

- In 2021, however, the market value of Iran’s oil exports increased to $30 billion—a 138% increase from the prior year.

Since the U.S. withdrawal from the JCPOA, Iran’s oil export revenue was lowest in 2020, when the price of oil reached record lows. Iran’s oil export revenue was highest in 2021, when the price of oil almost doubled from the previous year. But the difference between Iranian oil export revenues in 2020 and 2021 is not entirely the result of the rise in oil prices. As noted above, the total barrels of oil exported by Iran increased by 131 million between 2020 and 2021. At 2021 prices, Iran made an estimated $8.8 billion on that increase in exports.1 These revenue changes have led to an increase in the Iranian government’s military spending, which includes outlays to its terrorist proxies.

The Trump administration’s sanctions had a drastic impact on Iran’s economy. Iran capped its official exchange rate against the U.S. dollar at 42,000 Rials/Dollar, however, because of the sanctions, at the real unofficial exchange rate, Iran’s Rial was actually worth much less. In 2020, analysts estimate that the unofficial exchange rate reached 255,000 Rials/Dollar.

We calculated Iran’s military budget in 2020, 2021, and 2022, using the unofficial rate. The following chart shows a drastic increase in the military budget and the IRGC budget between 2021 and 2022—more drastic than between 2020 and 2021. This difference can be explained by the fact that the 2021 budget was drafted during Trump’s last year in office, and may have been based on the assumption of diminishing oil revenues. However, once it became clear that the Biden administration would not enforce sanctions as strictly as the Trump administration, the Iranian government drastically increased its military spending.

Iran's Military Spending Vs. Market Value of Iran's Oil Exports

| 2020 | 2021 | 2022 | |

|---|---|---|---|

| Military Budget2 | $2.8B | $4.5B | $10.5B3 |

| The Islamic Revolutionary Guard Corps Budget4 | $0.9B | $1.5B | $3.6B |

| Market Value of Iran's Oil Exports | $12.5B | $30.09B | $43B5 |

Analysts generally agree that Iran was forced to reduce its support to Hezbollah, Hamas, Palestinian Islamic Jihad, Iraqi proxies, and the Houthis as a result of the reimposition of U.S. sanctions, but because Iran does not publicly report how much it spends on its proxies, quantifying the impact of U.S. sanctions on proxy funding is difficult. The qualitative impact, though, can be discerned. Hezbollah had to close offices, furlough fighters, and lower wages. As a result, the group was less capable of waging Assad’s war against rebels in Syria. At the same time, Iran reduced payments to militiamen in Syria, and its promises to support Syria’s economic development were stalled. Moreover, Hezbollah’s television station Al-Manar was forced to cancel programs and lay-off staff; and its social programs were curtailed.

Amid a stalemate in the Iran nuclear negotiations, the Biden administration may be beginning to shift its posture vis-à-vis Iran. The administration issued sanctions targeting Iran’s oil sector on June 16, 2022, and July 6, 2022, under Executive Order E.O. 13846, which would be lifted under any return to the nuclear deal. Before these two designations, the Biden administration had only been levying sanctions based on authorities that would remain on the books, deal or no deal. Furthermore, on September 29, 2022, the U.S. Treasury Department sanctioned entities in India, China, and the UAE that facilitate Iran’s illicit shipment of oil. Again, these sanctions were issued under E.O. 13846.

Although the Biden administration now seems to be showing an interest in reducing Iran’s oil exports, more can be done to thwart the flow of oil revenue to the Iranian regime. There are several vessels owned by the entities sanctioned on September 29th that have not yet been sanctioned. Vessels that ship Iranian oil can be sanctioned, along with the owners, operators, and managers of vessels, and the flag states, insurers, port authorities, importing agents, classification societies, and other “maritime service providers”—each of which play an integral role in the shipment of Iranian oil.

The above charts show that Iran has gotten substantially richer over Biden’s first year in office—partly due to high oil prices but also due to the increased export volumes. An International Monetary Fund (IMF) report published at the end of 2021 shows that Iran’s foreign currency reserves more than doubled from a low of $12.4 billion in 2020 to a projected $31.4 billion in 2021. While it got richer, it increased attacks on the U.S. and its allies and remained intransigent in the nuclear negotiations. Given its revenue gains, Iran had less of an incentive to cooperate with U.S. demands. Iran’s sale of oil does more than diminish U.S. leverage in the nuclear negotiations, it allows the Islamic Republic to fund a U.S.-designated terrorist organization, the IRGC, and finance its network of terror proxies.

A large share of the Iranian regime’s military budget is earmarked for its terror proxy networks. Oil export revenue spikes therefore translate into the growth of money allocated to Iranian terror proxies, which in turn has led to an increase in attacks by these proxies. This result is a direct threat to our national security interests, as well as those of our partners and allies in the region. Yet, there is no reason for Iran to scale back these activities. Iran’s proxies and military—let alone its nuclear and ballistic missile program—directly benefit from sanctions relief.

--

[1] If we calculate the average yearly price of oil, across all regions, by dividing the total revenue gained by the total number of barrels of oil exported, we find that in 2018 the average was 71.5 dollars per barrel (DPB); in 2019, 62.4 DPB; in 2020, 36.3 DPB; in 2021, 67.3 DPB; and in 2022, 98.8 DPB. These numbers help distinguish between the causes of the Iranian revenue changes.

[2] The 2020 and 2021 numbers are taken from SIPRI’s estimate of the total military budget in local currency. They were then calculated at the unofficial exchange rate of 255,000 Rials/Dollar.

[3] The 2022 numbers are based on our own calculation of the military budget at the unofficial rate. We defined military budget to include the budgets of the Ministry of Defense, IRGC, Army, General Staff of the Armed Forces, NAJA, and the IRGC Khatam Headquarters.

[4] These numbers were taken from an Iran International report found here. They were calculated at the unofficial exchange rate of 255,000 Rials/Dollar.

[5] $43 billion is a projection based on the total value of oil exports through July 2022.

Receive Iran News in Your Inbox.

Eye on Iran is a news summary from United Against Nuclear Iran (UANI), a section 501(c)(3) organization. Eye on Iran is available to subscribers on a daily basis or weekly basis.